Governance

Financial Information

Port Freeport Values Transparency

Check out our comprehensive annual reports.

Notice and Disclaimer: Information on this website is provided for general informational purposes only and not as a source of investor information. Investor information, including official statements and continuing disclosure, is publicly available on the Municipal Securities Rulemaking Board's Electronic Municipal Market Access System ("EMMA") website. No person should make an investment decision in reliance on the information on this website, nor does anything contained on this website constitute an offer to sell securities or the solicitation of an offer to buy securities. Information on this website, including Port Freeport's Annual Reports and Monthly Financial Reports, contained on this website speaks only as of its date. By choosing to view the information on this website, you are acknowledging that you have read and understood and accept the terms of this Notice and Disclaimer.

Download Port Freeport's Annual Report

Each year, our commission publishes an annual report of Port Freeport’s business, environmental, and social responsibility accomplishments. You can find and download the reports here, in PDF format.

If you are unable to view or download the documents below download Adobe Reader, click here.

- Financial Report for October 2025

- Financial Report for September 2025

- Financial Report for August 2025

- Financial Report for July 2025

- Financial Report for June 2025

- Financial Report for May 2025

- Financial Report for April 2025

- Financial Report for March 2025

- Financial Report for February 2025

- Financial Report for January 2025

- Financial Report for December 2024

- Financial Report for November 2024

- Financial Report for October 2024

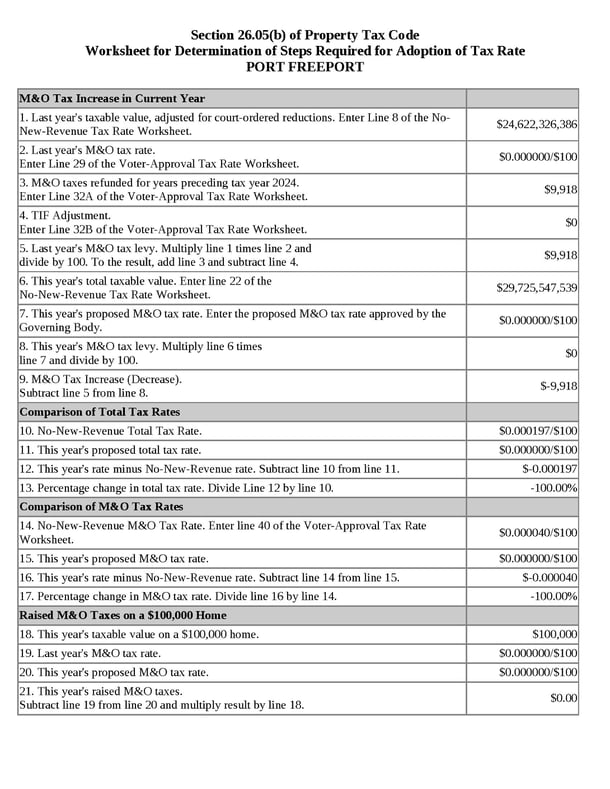

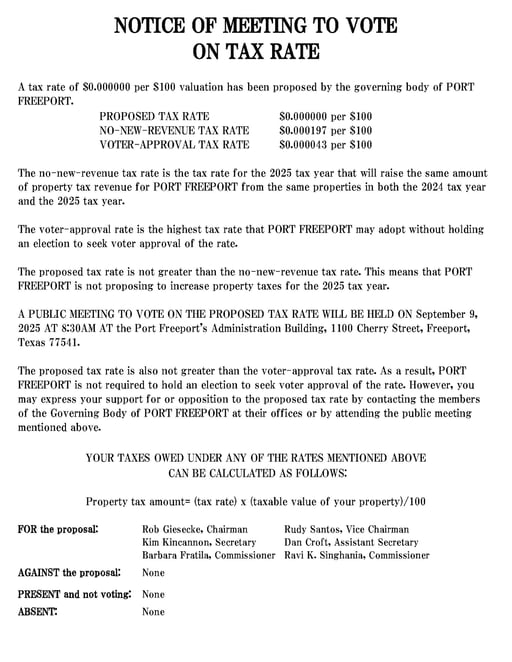

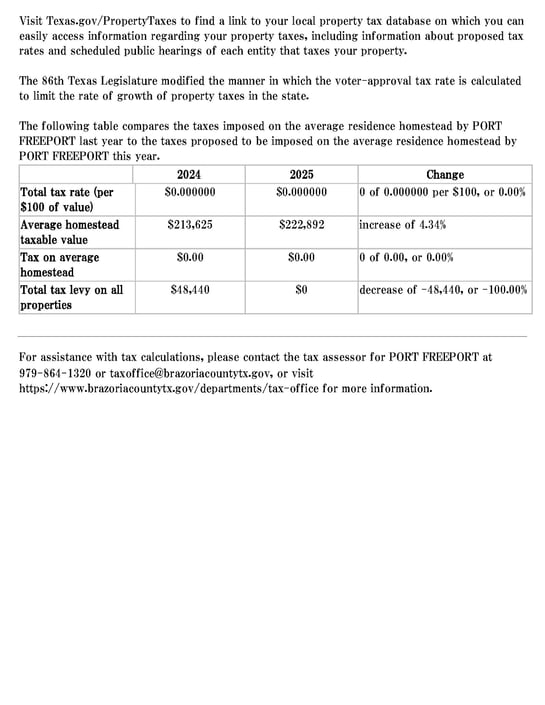

Property Tax Code

Additional Resources

Bond Rating Reports

Notice and Disclaimer: Ratings and ratings reports reflect only the views of the ratings agencies providing the reports or the ratings, and the Port makes no representation as to the appropriateness of the ratings or the information and conclusions contained in the reports. There is no assurance that such ratings will continue for any given period of time or that they will not be revised downward or withdrawn entirely by such ratings agencies, if in the judgment of either or both companies, circumstances so warrant. For information regarding the ratings and the ratings reports or actions that may have taken place to after the dates of the reports, readers should contact the ratings agencies. The Port is not undertaking any obligation to update the ratings information.

Download Bond Information

If you are unable to view or download the documents below download Adobe Reader, click here.